MSFT Annual Shareholder’s Meeting Dec 10, 2024 Proposes Investing in BITCOIN

Shareholders Propose an Assessment of Investing in Bitcoin.... The Board of Directors recommends a vote AGAINST the proposal

Microsoft Shareholders hold a vote to consider Investing in Bitcoin at The Annual Shareholder’s Meeting Tuesday, December 10, 2024

The Board of Directors recommends a vote AGAINST the proposal

MSFT FY 2023, a record $211 billion in revenue and over $88 billion in operating income is proposing a shareholder vote to consider investing in Bitcoin.

Proposal 5: Assessment of Investing in Bitcoin (Shareholder Proposal)

National Center for Public Policy Research has advised us that they intend to submit the following proposal for consideration at the Annual Meeting.

Bitcoin Diversification Assessment

Supporting Statement:

In periods of consistent, and often rampant, inflation, a company’s financial standing is unfortunately measured not only by how well it conducts its business, but also by how well it stores the profits from its business.

Corporations that invest their assets wisely can, and often do, increase shareholder value more than more profitable businesses that don’t. Therefore, corporations have a fiduciary duty to maximize shareholder value not only by working to increase profits, but also by working to protect those profits from debasement.

The average inflation rate in the US over the last four years according to the CPI – which is a remarkably poor and corrupt measure of inflation – is 5.03%, peaking at 9.1% in June, 2022. But in reality, the true inflation rate is significantly higher than that, with some studies estimating it to be nearly double the CPI at times. So a corporation’s assets have needed to appreciate at those rates over the last four years just to break even.

As of March 31, 2024, Microsoft Corporation has $484 billion in total assets, the plurality of which are US government securities and corporate bonds that barely outpace inflation (if assuming that the CPI is accurate, which it isn’t, so bond yields are actually lower than the true inflation rate).

Therefore, in inflationary times like these, corporations should – and perhaps have a fiduciary duty to – consider diversifying their balance sheets with assets that appreciate more than bonds, even if those assets are more volatile short-term.

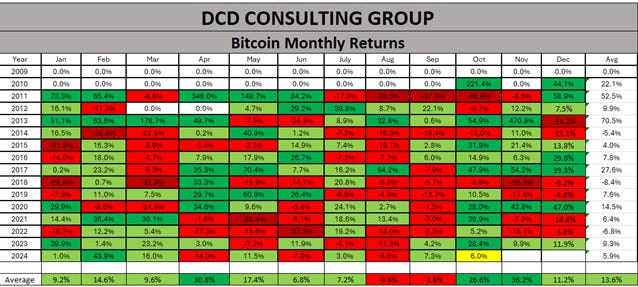

As of June 25, 2024, the price of Bitcoin increased by 99.7% over the previous year, outperforming corporate bonds by roughly 94% on average.

Over the past five years, the price of Bitcoin increased by 414%, outperforming corporate bonds by roughly 411% on average.